Easy Christmas Savings Plan for 2025 (have enough money for the holidays this year!)

Christmas savings plan for 2025! How to save money for Christmas this year, so you can actually enjoy the holiday season!

Even though Christmas comes around every year …

… most of us forget to save money for it, until it’s already here.

What if this year we saved a little each week, so we’ll be ready for all the gift-shopping, food-buying, and special events we love so much?

That’s the beauty of a Christmas savings plan!

How do I save for Christmas?

#1 Set a goal or budget

Knowing how much you want to save for Christmas is the first step.

Make a quick Christmas budget to decide your savings goal.

Be sure to include these items in your holiday budget:

- Gifts

- Travel

- Donations

- Clothing

- Food

This way you’ll know what you’re aiming for, and can work backwards so you know how much you save each month or week.

Let’s say you decide that you want to save $1000, and there are 25 weeks until Christmas, You’ll want to save $40 a week to reach your goal.

Or if you get paid biweekly, you could save $80 per paycheck.

SAVINGS GOAL / # OF WEEKS OR PAYDAYS REMAINING = Amount to save per week or paycheck

#2 Open a special savings account

Back in the day, banks and credit unions offered ‘Christmas club savings accounts’ where you could deposit and save money throughout the year for the holiday season.

Fewer banks offer these Christmas-specific accounts now, but you can still open one of your own!

To start a Christmas fund, open a designated savings account where you add money especially earmarked for the holiday season.

My current favorite savings account is with Ally Bank. It’s a high-yield account, meaning the savings % rate is SO much high than at your local bank or credit union.

Right now they’re offering new members $100 when you open a new account and set up monthly transfers – the easiest way to save!

Get it set up now, and when the holiday season rolls around, you’ll already have enough saved to start shopping!

#3 Automate your savings with transfers

Anytime you can automate your savings, it adds up without any effort from you.

You won’t accidentally spend the money, and you won’t miss it if it’s not there.

Ally Bank makes it so easy to set up a regular transfer from your checking to your savings account.

Choose a specific day of the week or date of the month to move your savings into your new Christmas account.

If you get paid on Fridays, you could set the transfer up to move the money every Saturday.

You’ll totally forget it’s even happening, but your savings will grow on autopilot!

#4 Cut back in one area

Maybe you’re thinking that this all sounds good, but you’re not sure where this savings is going to come from.

Your budget feels tight as it is!

Find one area of your budget that you could cut back.

Maybe it’s one fewer night of takeout each week. Or a spending freeze on new clothes or shoes for the rest of the year.

You might feel the pinch at first, but you’ll soon adjust to your new budget, and really thank yourself at Christmastime when you have the money ready and waiting.

#5 Add extra money to savings

Anytime you have a little extra cash, add it to your Christmas savings account.

If you get a raise or bonus, or work a little overtime, you can earmark it for the holidays instead of letting it get lost in the shuffle.

You could also find ways to lower your regular household bills (like cable, internet, or cell service), and add the difference to your holiday budget.

#6 Earn cash back and gift cards

I love using apps and services that earn money back, just by shopping like I normally would.

Some give cash back, and others let you redeem your points for gift cards.

You can save up the gift cards to buy presents in December, or for your regular groceries and household supplies throughout the year.

💡 Here’s a rundown of my favorite cash back services:

I love to use Rakuten (formerly Ebates) for ALL my online shopping. They offer a percentage of cash back at thousands of online retailers.

Best of all, Rakuten is currently offering my readers a $30 welcome bonus when you sign up!

Simply go to the Rakuten website before you shop online, search for your favorite store, then click through to that store’s website and shop like usual.

You can choose whether you’d like a check mailed to you, or if you prefer to be paid through PayPal.

We’ve used the Capital One Quicksilver card for years, and have loved earning money back on all our purchases (that we’d make anyway!).

They have a SUPER great offer for new members right now.

👉 You’ll receive $200 back when you spend $500 in the first 3 months.

Plus, they’re offering 0% interest for the first 15 months AND 1.5% cash back on every purchase.

Even if you just used it to buy groceries for the next few months, you’ll get $200 free!

That’ll really jumpstart your Christmas savings plan.

Be sure to sign up for Ibotta (and get a $10-20 welcome bonus!) before you go shopping.

Signing up on the app instead? Use code uwhaflc to receive your bonus.

You can earn cash back on brand name items, plus on ‘Any Brand’ offers.

Fetch Rewards is SO easy to use. Nothing to clip beforehand.

Just scan your receipt through the app after you shop, and they give you points for any applicable purchases.

Use code UGY82 to receive 2000 bonus points when you download the Fetch app.

#7 Earn some extra dough

Besides earning cash back with apps, you can find little ways to earn extra money for Christmas throughout the year.

You could offer services like:

- Dog walking

- Babysitting

- House-sitting (offer to bring in the mail, feed the pets, and water the plants while your friends or neighbors are out of town)

- Clean someone’s house

- Mow lawns (or pull weeds, shovel snow, etc.)

People are willing to pay for tasks they don’t like or don’t have time for.

In just a few hours a week, you could save a LOT for Christmas.

Get creative! You may even get a nice little side business going.

BONUS Tip: Shop for gifts throughout the year

There’s no rule that says you need to buy all holiday gifts in December.

To really stretch your Christmas budget, and take some of the strain out buying a ton of gifts at once, buy presents throughout the year.

Anytime you see a great price on something that would make a good gift, pick it up.

(The clearance section is perfect for this!)

It’s super helpful to keep a list of what you’ve bought, for whom, and where you hid it, so you actually remember it when the holiday season rolls around.

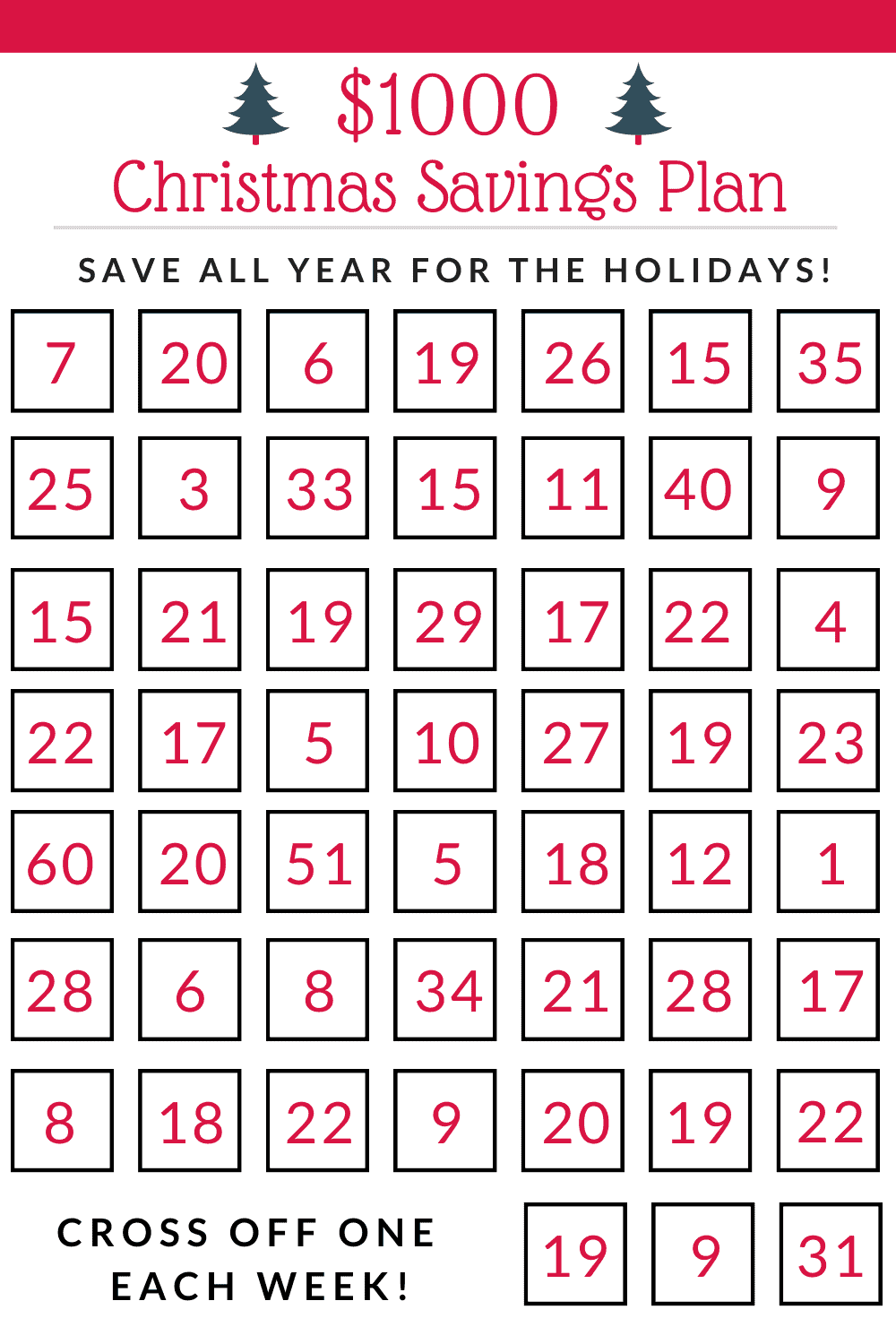

How can I save $1000 for Christmas?

I put together two different $1000 Christmas savings plans, depending on how much time you have.

With either one, you’ll end up saving $1000 by the time Christmas rolls around!

26 Week Christmas Savings Plan

52 Week Christmas Savings Plan

If you have a full year to save, try the 52 week savings challenge!

12 Week Christmas Savings Plan

If your budget is a bit smaller, or you only have a few months left till Christmas, here’s a 12 Week Savings Plan where you’ll save $600.

What is a good budget for Christmas gifts?

A good rule of thumb is that your total Christmas budget shouldn’t be more than 1% of your total annual income.

So if you earn $50,000 a year, a $500 budget (or less) is recommended.

You can determine how much of your total budget you want to spend on gifts.

It’s also helpful to make a list of the people you’d like to buy for, and pencil in an amount next to each.

That way you can see what your exact gift budget will be.

Shopping on a budget? Check out these inexpensive Christmas gift ideas:

- 51 Cheap & Creative Gift Ideas Under $10

- Easy-to-find Unique $25 Gifts

- 35 Homemade DIY Gift Basket Ideas

Ready to make a Christmas Savings Plan of your own?

As you can see, saving money for Christmas weekly does your ‘future self’ such a great service!

The peace of mind that comes with knowing the money is there and waiting for you is priceless.

It means you can get the best deals on Black Friday, or finish your shopping early instead of waiting till that last payday.

Your regular bills and budget won’t be affected by your holiday spending at all!

For more inspiration for doing Christmas on a budget, check out:

- 19 Things You Can Do NOW to Get Ready for Christmas Early

- How to Have a Magical Christmas Even if You’re Broke

- 21 Easy Ideas to Earn Extra Money for Christmas