10 Smartest Ways To Spend Your Tax Refund

10 smartest ways to use your tax refund! Here’s how to budget your tax refund so you can stretch it and really improve your financial situation.

Nothing makes winter more bearable than a nice tax refund!

There are lots of different ways you can use your refund, but why not use it to improve your life?

(And I’m not talking about buying a bigger TV.)

Here are 10 smart, rewarding ways to make the most of your refund.

You May Also Like:

- Budgeting for Beginners: A Step by Step Guide for Getting Started

- 15 Spending Leaks that are Destroying Your Budget

- How to Pay Off Debt Quickly: 15 Ways to Start Today!

This post may contain affiliate links. You can view my full disclosure policy here.

1. Save it as an emergency fund

This one goes first for a reason!

You absolutely MUST have an emergency fund. Ideally, it should be about 3-6 months of your expenses.

You never know when you’re going to get injured, or go through a health crisis, and can’t work.

Or you might need an expensive repair to your home or car. Or even lose your job.

If a goal of 3-6 months seems impossible, start with a goal of just $1,000.

Your tax refund can be a great jump start to any size emergency fund!

It really stinks when any of those things happen.

But what makes them hurt all the more is when you don’t have the money to pay for them.

Imagine being able to cover the cost of that unfortunate event, instead of having to borrow money. Or go into credit card debt over it.

Peace of mind really is priceless.

Related: 15 Money Saving Challenge Ideas (with something for every budget!)

2. Pay off credit card debt

Unfortunately, credit card debt can be like a runaway train you’ll never catch.

Even if you make the minimum required payment every month, it can take years to pay it off.

And if you keep charging while you still have debt, you’ll just continue to be buried.

Consider taking your tax refund and applying all of it to your credit card debt.

Even if that doesn’t pay it off completely, seeing your balance lower significantly is SO motivating.

If you find yourself grumpy that you can’t use your refund for something more fun, try picturing yourself free from credit card debt.

It can happen!

Related: The Easiest Way to Keep Track of Your Spending (+free printable!)

3. Catch up on past due bills

Are you perpetually behind on your bills?

Receiving a tax refund is the perfect solution!

Use that money to get caught up. You could start with the bills you’re furthest behind on, but definitely pay the ones that charge late fees.

You’ll start next month with a clean slate. Not to mention getting to live a life without creditors calling constantly.

Related: How to Recover from Holiday Spending…FAST!

4. Lump sum principal payment

If you’re all caught up on your bills and have an emergency fund, consider making a large principal payment on your mortgage or student loans.

Lenders base your monthly interest on the amount of principal you owe.

If you owe less in principal, you’ll pay less interest.

If you did this with your tax refund every year, you’d cut down the duration of your loan by years.

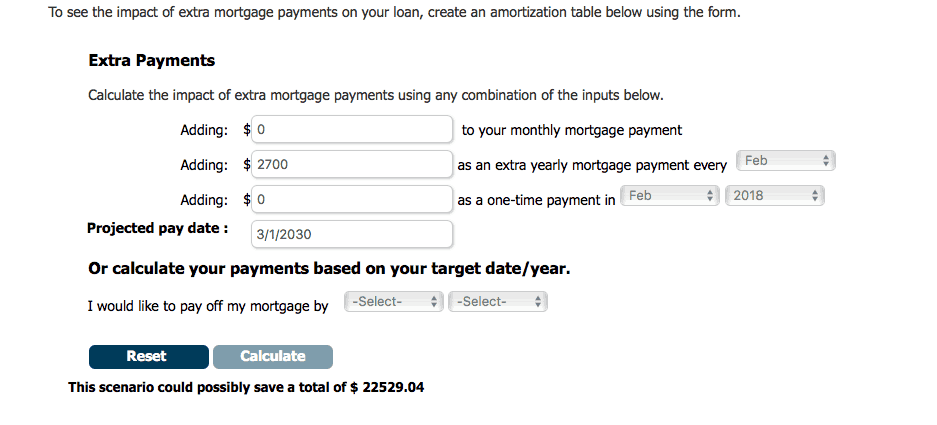

Example: I logged into our mortgage account, and used their calculator to get real numbers on our loan.

If we paid an extra $2700 every February (the national average tax refund amount), we would save $22,529! And it would shorten the loan by 7 years.

Trading in your tax refund in exchange for saving $22,529 and paying your mortgage off 7 years earlier seems quite a worthy reward to me.

Better than buying some useless “stuff” that you’ll soon forget about.

Especially when you’re stuck paying your mortgage or student loans til you’re 70 years old.

5. Contribute to a Roth IRA

A Roth IRA is a retirement account that grows tax free until you’re 59 1/2 years old.

Applying your tax refund to it can be very meaningful in the long run.

If you applied your $2700 refund to a Roth IRA just once, it would grow to $10,000 in 20 years (assuming 7% average yearly earnings).

If you contributed $2700 every year, it would grow to about $118,000 in 20 years.

You can do this in addition to a 401k from work.

It’s pretty easy to open a Roth IRA online yourself. Many financial experts recommend Vanguard or E*TRADE.

You will get old eventually. And you’ll certainly want to retire someday.

6. Invest in yourself

If you’re not convinced to use your tax refund for savings, debt payment, or retirement, try using it to improve yourself in some tangible way!

Is there a class you could take or skill you could learn that would allow you to make more money at your job?

Consider using your refund to cover it.

Maybe you could take a few hundred dollars, and put it towards starting a very small business or side hustle.

Here are 5 very profitable side hustle ideas.

That way you’ll start earning extra money!

The key here is to think it through, and only invest in something you truly believe could improve your life.

5 inexpensive personal finance books that will probably change your life:

7. Make a small home improvement

Is your hot water heater or furnace on its last leg?

Be proactive and replace or repair it before it becomes a big problem.

Spruce up your bedroom with a new coat of paint and a comforter.

A little facelift can really go a long way!

Related:19 Easy Ways to Make Your Bedroom Cozy

If your appliances are old and costly to run, investing in a new one could potentially lower your energy bills.

A programmable thermostat is a great way to save money on your utilities.

The temperature in your house doesn’t matter too much when you’re sleeping or not home.

8. Save for something big

Do you have a big expense coming up?

Or are you planning an expensive milestone vacation? If you have your financial ducks in a row, apply your tax refund to a big event.

Maybe you’re saving for a wedding, or your child’s graduation party. Use this money to boost that savings account!

Or save it for Christmas. It always seems to come around sooner than we expect and cost more than it should.

Having money set aside ahead of time sure beats putting these expenses on a credit card.

(And then paying for them months or years after the event has passed.)

Related: Flat out broke? Start by doing these 5 things.

9. Contribute to an education fund

Our children grow up SO much faster than we think they will.

Higher education is super expensive, so you may want to consider opening a 529 college savings plan.

The money will grow tax free and can be used for almost any educational expenses. Contributions may even be tax-deductible.

10. Just put it in your account

If you’re living paycheck to paycheck, you need a safety net!

Aside from an emergency fund, your checking account should have a buffer.

Some months have higher or unexpected bills.

Here’s the trick – you’ll need to put it on your checking account but not change the way you spend your money.

Pretend it’s not even there! This requires some accountability on your part.

You and your bank account will appreciate the money cushion soon enough.

How will you spend your tax refund?

Hopefully these 10 smart uses for your tax refund have given you some ideas.

If you were really hoping to use it for something “fun,” maybe compromise and use 10-15% of it for a more frivolous purchase or experience.

Your future self would definitely appreciate it if you make wise choices with your money today!

Be sure to also check out:

- 7 Ways to Pay Your Mortgage Off Early

- 10 Money Myths That Are Keeping You Broke

- 10 Things to Do to Finally Get Control of Your Finances

Do you get a tax refund? How do you plan to use it this year?