Where Does All My Money Go? 15 Spending Leaks Destroying Your Budget

Maybe you try to live within your means and not spend too much. But when you look at your bank account, you’re left wondering ‘where does all my money go?’ If you feel like your money keeps disappearing, check out these common spending leaks.

It’s so easy to spend more than you realize. Even if you don’t have extravagant expenses! It’s important to understand that it’s actually all the tiny expenses that add up over time that are destroying your budget.

I estimated the cost of ‘plugging’ these popular spending leaks, and multiplied that savings over 20 years. This offers an startling example of how big an impact our little habits and decisions make over time.

You May Also Like:

- 10 Money Myths That Are Keeping You Poor

- Where to Start When You’re Flat BROKE

- 12 Things Frugal People Don’t Do

- How to Finally Get Control of Your Financial Situation

This post may contain affiliate links. You can view my full disclosure policy here.

👉 Join our FREE 3 Day Budget Quickstart Challenge! It’ll walk you through creating a custom budget for YOUR exact situation.

Where Does All My Money Go?

15 Spending Leaks Destroying Your Budget

1. Convenience foods

Buying convenience foods can be a major leak in your budget.

Do you do any of these things?

- Buy 20 oz soda or water bottles at gas stations, or convenience or drug stores

- Purchase anything from a vending machine

- Get individually bagged food items, such as chips or cookies

- Buy already peeled and chopped fruit or vegetables at the grocery store

If so, you’re paying a huge premium for convenience! Vending machines and gas stations charge at least double for snack and drinks, compared to grocery stores.

With just a little forward thought and preparation, you can save so much money. Buy an 8-pack of soda next time you’re buying groceries (bonus points if it’s on sale), and put the bottles in the fridge.

Instead of buying little chip bags, buy a full-size bag and divide it into Ziploc baggies.

Spend a little more time, and a whole lot less money, by peeling and chopping your own fruits and vegetables.

By making your own ‘convenience foods,’ you will save hundreds, if not thousands of dollars a year!

Savings example:

- $2 a day saved

- $2 x 365 = $730/yr.

- $730/yr. x 20 years = $14,600

2. Brand name everything

If you insist on buying the name brand of everything, you’re definitely overspending! Sure, there are some things you want to be the real deal – running shoes and computers, for example.

But for most food items, home decor accents, and even a lot of clothing, the brand name is meaningless.

Try some generic brand foods next time you’re at the grocery store. For cereals, baking ingredients, canned or frozen vegetables, and crackers or cookies, the brand usually isn’t very important.

Aldi is one of the best places to save a LOT of money by buying generic. Here are the 70 best things to buy at Aldi.

Often the generic brands are actually even made by the name brand companies, but without the fancy packaging or high marketing budgets.

Savings example:

- $15 a week x 52 weeks = $780

- $780 x 20 years = $15,600

3. Disposable products

Using paper plates, napkins, and paper towels is kind of like throwing money into the trash.

This is another example of paying for convenience. You save yourself time by not having to wash as many dishes or towels, but the cost of buying these items over and over throughout your life is exponential.

Get a nice reusable water bottle instead of disposable water bottles. Use dishwasher safe plates and cups instead of buying the paper version. You could even experiment with cloth napkins or try life without paper towels.

Savings example:

- $5 a week x 52 = $260

- $260 x 20 years = $5,200

4. Going out to lunch

If you go out to eat every day during your lunch hour, you are definitely spending too much on food!

Even if you don’t go to a sit-down restaurant, fast food and takeout adds up so majorly over time.

Try packing your lunch more, and eating out less. Even if you brought your lunch 3 times a week, you’ll be surprised how much more money you have at the end of the month.

Savings example:

- $25 a week x 50 weeks (allowing for 2 weeks vacation) = $1,250 a year

- $1250 x 20 years = $25,000

5. Fees

Do you realize that you’re probably spending a lot of your money on fees? Avoidable fees at that!

Late fees for being behind on your bills range from $8-30. The average fee for using an out-of network ATM is now $4.69.

The interest you pay on any type of loan or credit card is also a huge spending leak!

Check your credit card bills and car loan or mortgage statements, and see how much of your monthly payment just goes to interest. That’s you making the banks richer!

Pay off your debt as quickly as you can to reduce how much interest you’ll pay over your lifetime.

It’s impossible to estimate how much interest you pay, or if you get charged late fees.

But here’s an example for just using an out-of-network ATM twice a month.

Savings example:

- $4.69 x 26 weeks/yr. =$121.94

- $121.94 x 20 years = $2,438.80

6. Drinks

From fancy coffees to energy drinks to your favorite happy hour, drinks can play a major part in destroying your budget.

Of course there’s no need to give up coffee or cocktails altogether. But there’s always a way to save money when you look for it.

Get a milk frother and some fancy syrup, and make your own lattes at home.

Have your friends over for drinks instead of going to the bar sometimes.

Savings example:

- $3 drink per day x 7 = $21/wk.

- $21 x 52 weeks = $1092/yr.

- $1092 x 20 years = $21,840

7. Memberships you don’t use

Remember that gym membership you signed up for but never use? Or that monthly subscription box that you always forget about until it arrives?

Cancel them!

There are so many things to become a member for right now. From Netflix and Hulu, to Stitch Fix and FabFitFun, to Sirius radio and Blue Apron.

Take a look at your credit card statement or bank account. Are there fees you’re being charged for monthly or yearly that you don’t utilize?

There’s no point in paying for something you don’t need or even want. Even if you keep meaning to get back to it, just cancel it for now.

Savings example:

- $30/mo. X 12 = $360/yr.

- $360 x 20 years = $7,200

8. Checkout lane purchases

If you buy candy, gum, or magazines from the checkout lane, you’re again paying for convenience. The stores aren’t dumb. They design the checkout lane to purposely encourage you to make impulse purchases.

If you buy a certain magazine regularly, it would make more financial sense to get a subscription. You’ll probably save 80% off versus the price of buying issues individually.

The candy and gum aisle at the grocery store offers much better prices than the checkout lane. I always buy Trident gum. The 3-pack variety is priced just above $2 (less if it’s on sale), but at the cash register it’s $1.09 a pack.

That’s like getting more than a pack for free. Doing some simple math when you compare prices can save you tons!

Savings example:

- $5 a week x 52 = $260/yr.

- $260 x 20 years = $5,200

9. Throwing away food

The average American household now throws away over $2,000 in wasted food every year.

If you let groceries spoil before you eat them, that’s like cash in the trash.

The solution? Give meal planning a try! By planning your meals before you shop, you won’t buy more than you’ll use.

Plus, it makes dinner time way easier.

Savings example:

- $2000 a year x 20 years = $40,000

Some handy dandy meal planning resources:

- How to Get Started Meal Planning Today: 10 Super Easy Tricks

- 5 Easy Meal Planning Strategies for Beginners

- 10 Cheap and Easy Meals that ANYONE Can Make

- 30 Delicious Ways to Use a Pound of Ground Beef

10. Guilty pleasures

Habits like smoking cigarettes or playing the lotto really add up to so much extra money spent over a lifetime.

We probably all have a vice or too, and it’s just important to look periodically at how much those habits are actually costing us.

Savings example:

- $6 per day x 7 days = $42/wk.

- $42 x 52 weeks = $2,184/yr.

- $2184 x 20 years = $43,680

11. Your car

Unfortunately, your car just isn’t an investment. Like most things you buy, cars lose value once you’ve purchased them.

Please don’t fall into the trap of thinking that ‘reliable transportation’ always means a brand new, expensive car.

New cars lose their value extremely quickly, whereas you can purchase a gently used 1-4 year old car for virtually half the price.

Another huge spending leak is your car payment. Many people buy a far more expensive car than they can actually afford. And get a 5-6 year loan to pay for it!

That is so much wasted money spent on interest. Not to mention the increased cost of buying something you can’t really afford.

The average car payment has now reached $523 a month.

Savings example:

- $523/mo. X 12 months = $6,276

- $6276 x 20 years = $125,520

The ideal solution is to save enough money to pay cash for your cars. Failing that, the rule of thumb is to get no more than a 36 month loan.

If you can’t afford the payments on a 3 year car loan, you can’t afford that car.

And if you are serious about not being broke for life, make sure you’re saving or investing more money each month than you car payment costs!

12. Overpaying for services

It’s so important to be an informed consumer. That means comparing prices. Far more things are negotiable than you might realize.

Be sure to look at your monthly bills to make sure there hasn’t been a price hike. If you notice a change or mistake, give them a call.

I have had enormous luck by calling cable or internet providers or our cell phone company to see if there are similar plans available at a lower cost.

I’ve even had them offer a $10 monthly credit for being a long-time customer.

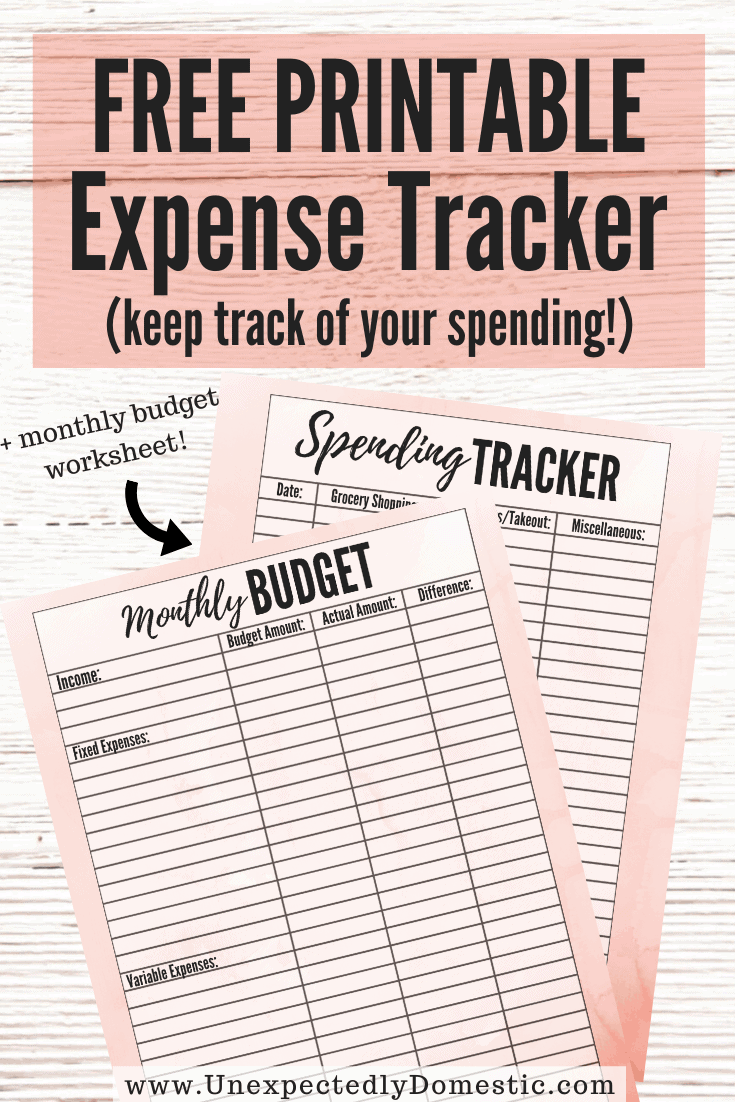

Keeping a simple monthly budget will help you notice changing prices more easily.

Related: Budgeting for Beginners: A Step-by-Step Guide for Getting Started

Some bills that are up for negotiation include:

- Auto or home insurance

- Cable

- Cell phone provider

- Credit card interest rate

When you call, be polite and just let them know you are no longer able to afford their service. Most of the time they will offer a lower-priced solution, rather than lose you as a customer.

Also keep an eye on the cost of services like getting your hair and nails done. You could go less often to save money.

If you’re in debt, your money would be far better used toward financial freedom than manicures.

Related: How to Pay Off Debt Quickly: 15 Ways to Start Today

Savings example:

- $30/mo. x 12 months = $360

- $360 x 20 years = $7,200

13. Impulse purchases

You know all those times you just randomly buy something you don’t need without really thinking about it?

That really adds up!

If you’re always adding extra things to your shopping cart, or just buying any old thing without thought, please stop!

Chances are you definitely don’t need that item, and will probably soon forget about it.

We throw so much money away on stuff we don’t even love.

Before buying something, ask yourself:

- What am I going to use this for?

- Where am I going to keep it?

- Have I ever thought about buying this before, or am I just interested because it’s in front of me now?

If you don’t have a good answer for all three questions, you can assume it’s a waste of money. Leave it behind with no regrets.

Plus, there’s something about exercising self control that just makes us stronger.

Savings example:

- $10/wk. X 52 weeks = $520

- $520 x 20 years = $10,400

14. Buying more to save more

I’m so guilty of this! It’s almost painful for me to pass up a ‘good deal.’

But it’s not a good deal if it means spending money that I wouldn’t have otherwise spent.

Another way this plays out is when you have to spend more to use a coupon or get free shipping.

I’m trying to be better about buying something just because I have a coupon. By asking the same ‘before you buy’ questions as above, we can be more intentional about what we spend. And what we bring into our already-full homes.

15. Overspending on food

Food can be one of the biggest expenses in our budget. Luckily, there are lots of ways to plug that spending leak!

You can save so much money by changing up the way you grocery shop. By buying mostly what’s on sale (and shopping with a list and a plan), your can drastically reduce your grocery bill.

Use these resources:

- 5 Super Easy Ways to Save Money on Groceries (without using coupons!)

- The Quickest & Easiest Way to Create a Grocery Budget and Stick to It

- 10 Surprising Advantages of Doing a Pantry Challenge

Going out to eat is probably the biggest way most people overspend on food. It’s easy to use the excuse that it’s food, and ‘hey, we need to eat!’

Add up how much you’ve spent eating at restaurants or getting take-out over the past month. It might just shock you.

The one simple change of preparing more of your own meals will leave so much extra money in your bank account!

Spending example:

- $200/mo. X 12 = $2,400

- $2400 x 20 years = $48,000

Adding it up

One of the best ways to stop wondering ‘where does all my money go’ is to add it up as you go. Let’s see how much these spending leaks actually cost us.

Over 20 years, the grand total for all these habits is $371,878!

By making some changes (and plugging your spending leaks), you could quite literally save hundreds of thousands of dollars.

I was quite shocked when doing the math. And motivated! Obviously these figures are rough estimates. The results of the spending changes you make will vary.

Not only do these examples reflect money saved, but had you invested this money instead of spending it, your money would have earned more money!

Take a look at your own habits, and see where your budget could be trimmed.

Pick a spending leak or two and break down how much it’s truly costing you per week or month.

Add up how much plugging that leak will save you over the next decade or two.

Every tiny decision truly has long-lasting impact when combined over years.

Do your future self a huge favor, and make some changes now. You just might make yourself many thousands richer!

P.S. Don’t forget to join the FREE 3 Day Budget Quickstart Challenge! It’ll walk you through creating a custom budget for YOUR exact situation.

You may also like these other motivational resources: